IRS Announces Tax Inflation Adjustments for 2025: What You Need to Know

Table of Contents

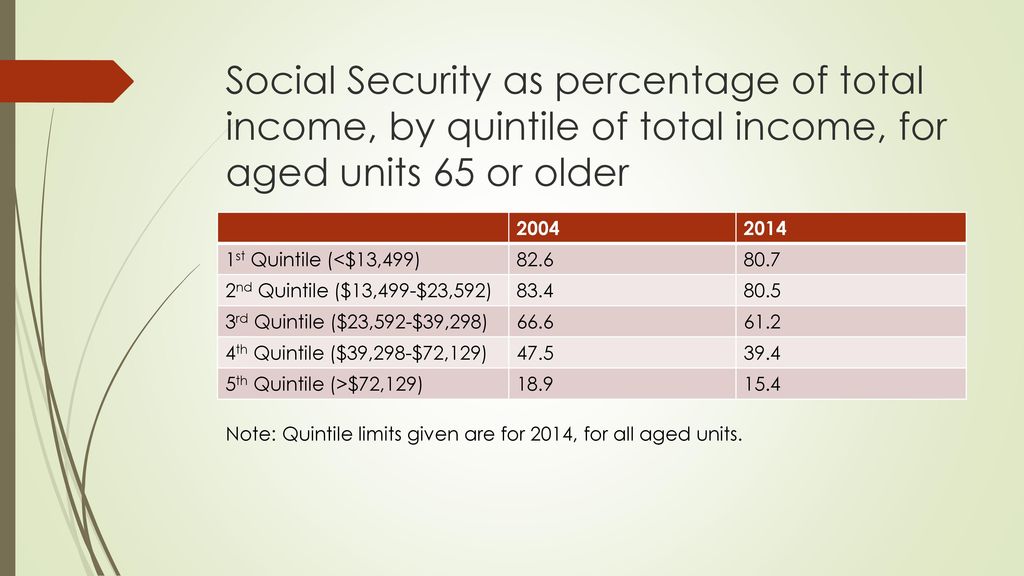

- Sources of Income for those Aged 65 or Older, - ppt download

- Everything is going to change forever on Social Security benefits in ...

- 2025 Social Security COLA Estimate - Latest Update - YouTube

- Social Security 2025 COLA estimates: What to know about increase | wfaa.com

- 2025 Social Security Projections: 3 Things to Know [COLA] - YouTube

- Good News"2025 Social Security COLA Revealed: Upcoming Boost in SSI ...

- Social Security Announces 2.5 Percent Benefit Increase for 2025 | SSA

- Social Security Increase For 2025 Chart Calculator

- Social Security COLA Increase 2025: What to Expect for Adjustment ...

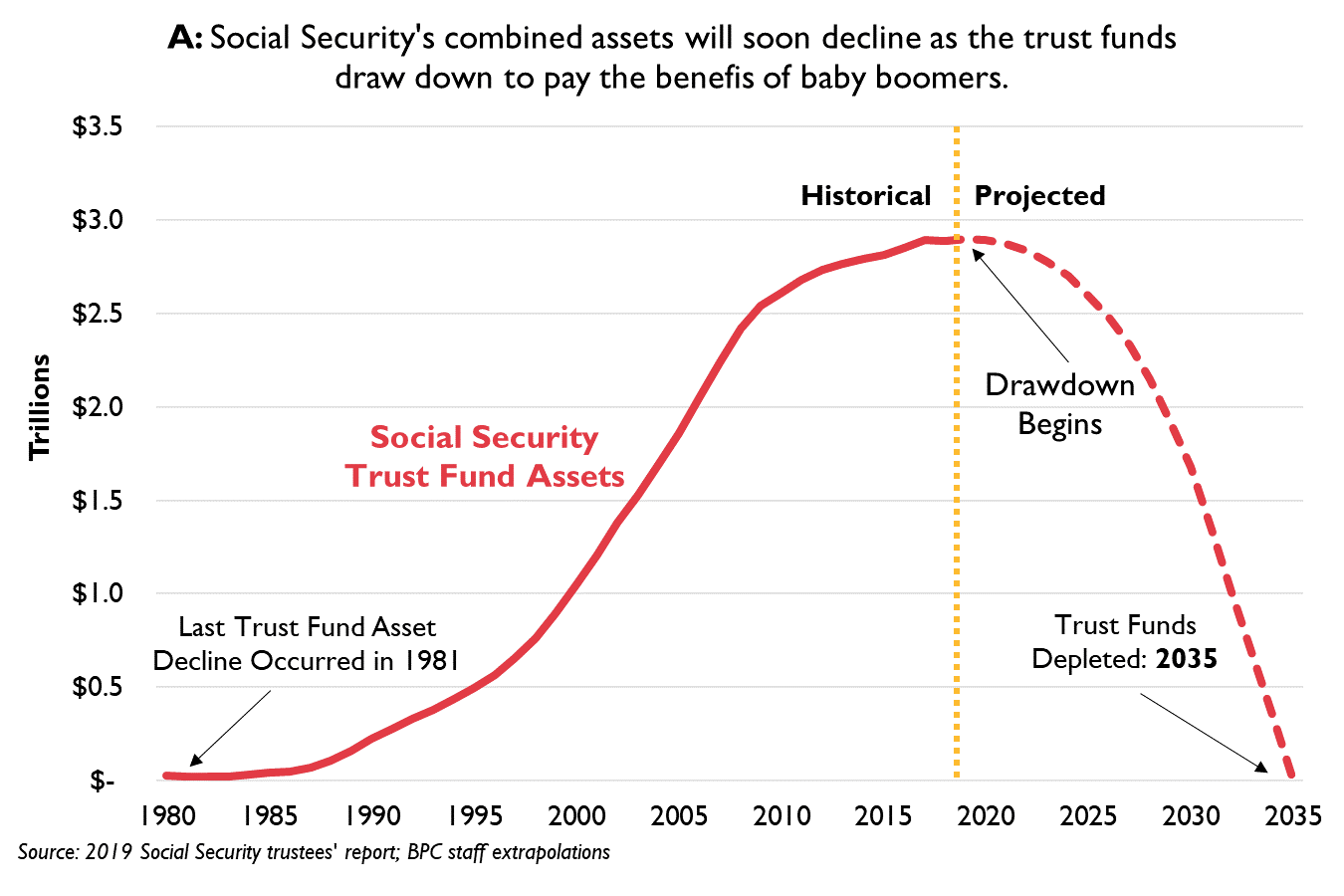

- Understanding the New Social Security Projections in Five Charts ...

![2025 Social Security Projections: 3 Things to Know [COLA] - YouTube](https://i.ytimg.com/vi/l-0Qc1M12c4/maxresdefault.jpg)

Understanding Tax Inflation Adjustments

Key Adjustments for Tax Year 2025

Impact on Taxpayers

These adjustments will have a significant impact on taxpayers, particularly those in higher tax brackets. The increased standard deduction and exemption amounts will provide relief to many taxpayers, while the adjusted tax brackets will help prevent bracket creep. Additionally, the increased estate and gift tax exemption will benefit high-net-worth individuals and families.

Planning Opportunities

The tax inflation adjustments for 2025 present several planning opportunities for taxpayers. For example: Tax Bracket Management: Taxpayers can take advantage of the adjusted tax brackets to minimize their tax liability. This may involve accelerating or deferring income to take advantage of lower tax rates. Charitable Giving: The increased standard deduction may impact charitable giving strategies. Taxpayers may need to consider alternative strategies, such as bunching donations or using a donor-advised fund. Estate Planning: The increased estate and gift tax exemption provides an opportunity for high-net-worth individuals and families to review and update their estate plans. The IRS tax inflation adjustments for 2025 are designed to keep pace with inflation and prevent unfair tax penalties. Taxpayers should be aware of these changes and how they may impact their tax situation. By understanding the key adjustments and planning opportunities, taxpayers can take proactive steps to minimize their tax liability and achieve their financial goals. As always, it is essential to consult with a tax professional to ensure you are taking advantage of the available tax savings opportunities.This article is for general information purposes only and should not be considered tax advice. Please consult with a qualified tax professional to discuss your specific tax situation.